Purchasing, selling and disposing of assets

Each individual asset is managed within the asset year's register.

When your client buys or sells an asset during the year, you'll need to record the monetary exchange in your general ledger and update your asset register to reflect the transaction.

Purchasing an asset

If your client has purchased an asset during the financial year, you'll need to record the purchase of the asset in the general ledger and then create the asset in Assets Live to calculate the accumulated depreciation accrued during the year.

The account code in which the amounts are posted to are specified in your Control Group settings.

- From within your client's Client Accounting >Workpapers tab, double-click on the workpaper period to open.

- From the TASKS bar, click Add Journal.

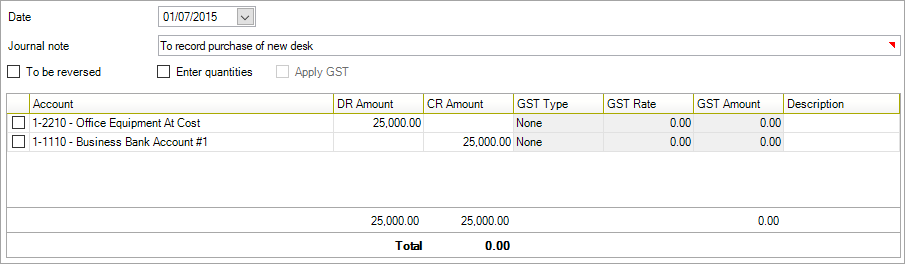

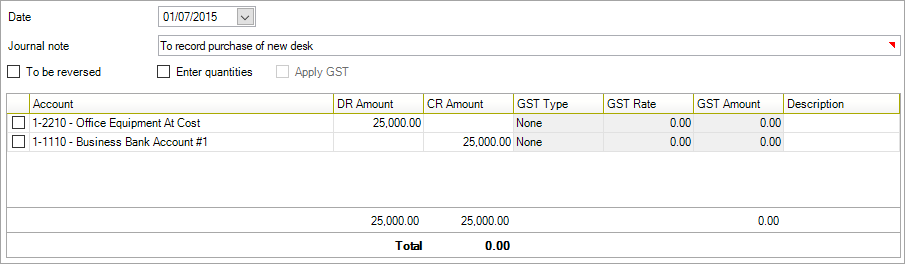

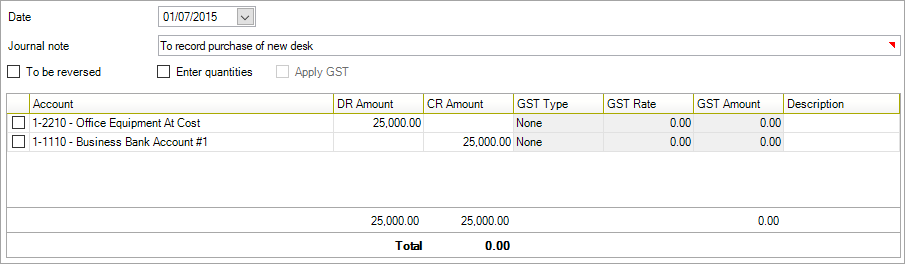

- Record the purchase of the asset, for example:

- Click Add. This journal will be posted when you click Post journals & accounts on the TASKS bar.

- From within your client's Client Accounting >Assets tab, double-click on the assets year to open the assets register.

- Within the asset register, click Create new asset on the TASKS bar.

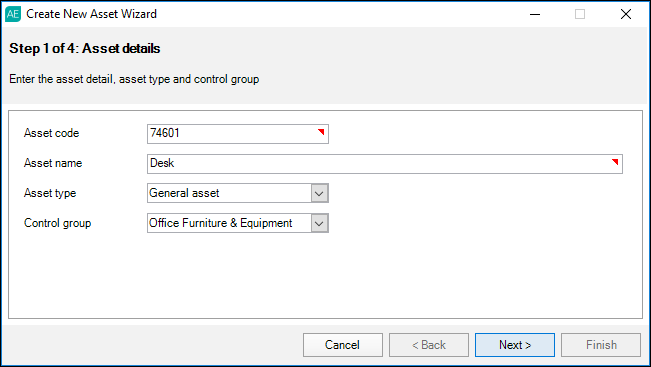

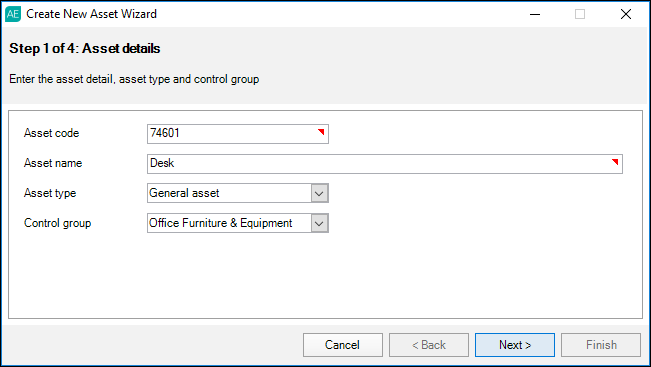

- Enter an Asset code and an Asset name.

- Click the Asset type drop-down menu and choose from:

- General asset

- Low value pool asset (AU)

- Small business pool (AU)

For Immediate deduction assets, choose the Asset type of General asset. When entering the Taxation and/or Accounting details of the asset, choose the depreciation method 'Immediate write-off'. The asset will be depreciated at 100%.

Click the Control group drop-down menu and choose a control group to allocate the asset to.

Click Next and complete the Taxation and/or Accounting details for the asset. For information on how to complete each field, check out our help topic on Creating an asset.

Once you've completed the Taxation and/or Accounting details, click Next and complete the General details (optional).

Click Finish to add the asset and close the Create New Asset wizard.

Selling an asset

- From within your client's Client Accounting >Workpapers tab, double-click on the workpaper period to open.

- From the TASKS bar, click Add Journal.

- Enter a journal to record any cash exchange.

- Click Add. This journal will be posted when you click Post journals & accounts on the TASKS bar.

- From within the asset year, select the asset to be sold from the Assets Listing.

- From the TASKS bar, click Sell.

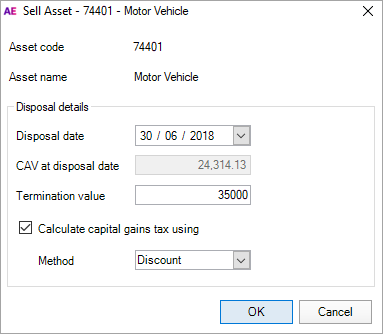

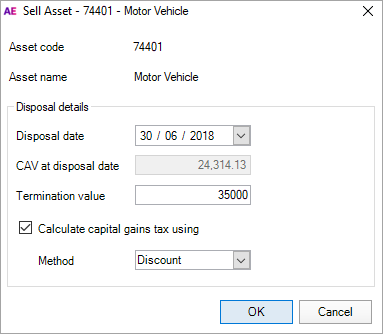

- In the Sell Assets window, Enter the Disposal date of the asset in the format dd/mm/yyyy or select it from the drop-down calendar.

The CAV (Closing Asset Value) at disposal date is calculated based on the disposal date entered. The Disposal date cannot be earlier than the asset start date, or later than the current financial year.

(NZ) this does not include depreciation for the year the Asset is being sold in.

(AU) If required, select the Calculate capital gains tax using checkbox and select the CGT calculation Method from the drop-down menu (i.e. Discount or Indexation). This checkbox is only active if the depreciation calculation is for Taxation purposes. See Capital gains tax for more information.

Click OK to sell the asset and close the window.

On the Assets Listing page, the entry line for the sold asset will be greyed out.

For full details on selling an asset, including how proceeds on sale are calculated for posting to the ledger, see Selling an asset.

Deleting an asset

Deleting an asset removes the asset from the database for the current year and any subsequent years. Y ou can only delete active assets in the year it was created.

There are some restrictions on which assets you can and can't delete, such as if the asset has been pooled in a prior year or sold in a subsequent year.

If you've made a mistake by pooling an asset in the prior year, you can set all values in the asset to $0 and add a journal to adjust the opening pool balance in the general ledger.

- From within the asset year, select the asset to be deleted.

- With the asset selected, click Deleteasset on the TASKS bar.